- The Lodge Social

- Posts

- Which is Better: Short Term Rental vs. Long Term Rental Investing

Which is Better: Short Term Rental vs. Long Term Rental Investing

An interview with a man who has both

TL,DR

1. Favoring Long-Term Rentals: Scott currently favors long-term rentals due to consistent revenue and fewer issues, even though short-term rentals can yield higher monthly income.

2. Operational Challenges: Short-term rentals, like Airbnb, demand more management and upkeep but offer greater revenue than long-term rentals.

3. Current Long-Term Rental Marketing Approach: Scott primarily uses Zillow for property listings, likening its market leadership to Tesla’s position in the electric car segment.

4. Current Short-Term Rental Marketing Approach: Scott mainly interacts on Facebook and Airbnb for business, but sees the potential in having a dedicated website.

For all the non-readers out there

I’ve always been interested in the short-term rental space. It’s sexy and exciting to work on.

While STR is the avenue I’m personally invested in with my money, there is another direction people like to take and most real estate professionals root for.

Long-term rentals.

Before I put my money where my mouth is for short-term rentals, I did look into the long-term rental option. In this interview with Scott Koke, you will understand that both investing options are not created equal.

Quite frankly, they couldn’t be more opposites.

Many people dive head first into real estate investing without making informed decisions between short-term and long-term rentals. Doing this leaves them working more than they want with multiple mortgages to their name.

One thing to note before we get started, I’m not a real estate professional and nor do I care to be. In these articles I take a look at the hospitality industry through the lens of marketing, operations and finance.

In short – I look at the short-term rental space like a business owner, not a real estate investor. I hire people for the real estate stuff.

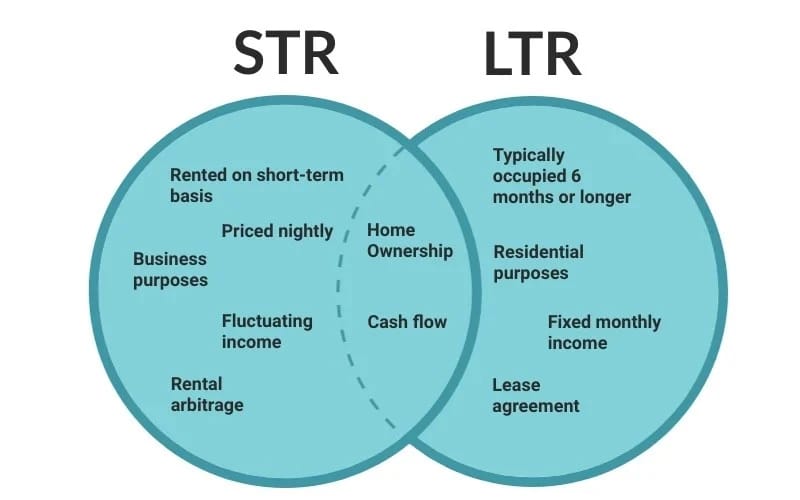

Short-Term and Long-Term Rental Investing Are Not Created Equal

Here are the differences between the two business models:

Difference #1: Cash Flow

Difference #2: Operational Costs

Difference #3: Marketing Strategy

After talking with Scott Koke I became very clear on why he chose the long-term rental avenue and why I chose to take the short-term option.

Hint: It all comes down to what you want from your business.

Long-Term Rental Cash Flow is Sustainable

After this interview with Scott, it was very apparent which model produces more sustainable cash flow.

With long-term rentals, you only have to fill your spot once a year and you have cash coming out every month for one lap around the sun. Retention is higher – and in any business – higher retention, more money.

With his short-term rental, we talk about how he has to fill the calendar every week. Even though his customers (or tenants) pay a nightly rate that he can charge more for versus a LTR, there could be some days that don’t kick any cash. This could leave him trying to fill his schedule, which costs time and money.

Obviously, like any business, the more work you put in, the better chance you’ll get more out. But that didn’t fit Scott’s lifestyle. Hence why he took the LTR option.

Operational Costs: Night and Day

If you don’t own any of these assets, I’m sure you can assume that short-term rentals produce a higher top line (more revenue).

Your volume is higher and the experience is wanted by more people. That means you can charge more per night for it.

However, more people coming in and out your doors means more work for you or the management team.

This eats up your margins. One month some guy might break a door and the next you gotta buy a bunch of supplies because no one is going to bring their own soap or dishes.

While you can earn more revenue per month with short-term rentals, your operating cost is significantly higher than the alternative LTR option.

But just like any business, if you can systemize and streamline your operations, you could lower the turnaround time which means less work for your management and more cash in your pocket.

Marketing Strategy

If you watch/listen to the interview with Scott, this is where I get the most excited. I love learning how Entrepreneurs like Scott approach marketing using different tools and strategies.

This segment of the interview surprised me. Scott talked about how Zillow pretty much owns the Long-Term Rental marketplace. He’ll just put the properties on Zillow and fill up a 12 month calendar through that one channel. For all of his properties.

My recap: Have a property in a desirable location, like colleges, upkeep the property nicely and put it on Zillow.

Seems simple enough.

Then we dove into marketing for his short-term rental. Like any STR investor, he lists on Airbnb and VRBO.

While he finds success through those two channels, he recommends STR Entrepreneurs take marketing into their own hands by building their own website and doing their own social media marketing.

To me, it makes sense. Like I said earlier, STR retention is just a couple days. Which means you always need to keep working to fill your calendar.

With my STR concept, the first thing I did was take marketing into my own hands.

I believe if STR Entrepreneurs can build an audience around their property, they will have an endless pipeline of customers and never worry about where the next booking is coming from.

It All Comes Down to What You Want

This interview ends like any other. I ask Scott about the vision he has for the future of his business.

Scott wants to optimize for freedom of time. To do whatever he wants in life.

Long-Term rental investing allows him to do that.

I want to play the game. I want to do my own marketing, create a brand and optimize for profitability.

That’s why Short-Term rental investing is the best option for me.

Deciding which path is right or wrong comes down to what you want.

That’s all for today.